Go To TTD's Pre-Market Opening Breakout Watch List -Monday, April 14

Go To TTD's Day Trades (win rate 80% for aggressive investors) for Monday, April 14

|

Go To TTD's Pre-Market Opening Breakout Watch List -Monday, April 14 |

Go To TTD's Day Trades (win rate 80% for aggressive investors) for Monday, April 14 |

By Leo Fasciocco -- TTD

Ticker Tape Digest presents its daily breakout and Short Selling report.

It contains Breakout Stocks and Stocks under  Significant Accumulation.

Significant Accumulation.

Data is from tape action for the day. These stocks are most suitable for aggressive investors seeking ideal entry points for leading stocks.

These stocks will do very well during bull markets and strong market rallies.

TTD also presents Stocks To Sell or Sell Short. These issues are suitable for aggressive investors willing to take short positions both as trades or for longer-term plays. These stocks

will do very well during bear markets or market corrections

TTD's multi-media updates include a slide-show that presents charts and analysis at midsession. Some times TTD presents feature analysis on stocks and the market. TTD uses Windows Media Files. (WMV).

TTD also presents a "Breakout Watch List" that is up dated daily. This list consists of key stocks in position to breakout. A close watch of this list can put you in the stock just as it breaks out.

TTD often suggests using stop buy orders to enter. It is very important to buy a breakout stock as close as possible to the break point. The idea is to get "elbow room" if the stock should follow through to the upside. This is very important in being successful in making big money with breakout stocks.

TTD also has special feature sections on Educational Tips on Investing.

To email Mr. Leo Fasciocco leo@tickertapedigest.com.For service, email Beverly Owen owen@tickertapedigest.com. TTD’s Tel: 1-480-926-1680.

TTD Quick Trade Stocks. These are leading issues that have pulled back in recent days, but could move higher soon. They are most suitable for Aggressive Investors willing to trade short term. These stocks will do extremely well during market advances. They have about an 80% win rate.

Ticker Tape Digest's Midsession Stock Market Video Show(Posted 12:30 to 1 p.m. NYSE Time) Go to TTD Stock Market Show For - April 14Go to Shows for Latest Week: Monday

-

Tuesday

-

Wednesday

-

Thursday

-

Friday

|

Total Buy Breakouts so far today - 8

Stocks Screened - 8,200

Bull side - Only a few breakouts today with energy stocks dominating the list. Bulls be very selective.

Long- term Environment for bulls: Bearish

Market Status (Daily) - NYSE Bearish, Nasdaq Bearish

Market Status (Weekly) -NYSE Bullish, Nasdaq Bullish

Market Status (Monthly) NYSE Bullish, Nasdaq Bullish

DO, based in Houston, is an offshore contract driller for oil and gas. The company has 43 rigs drilling around the world. Annual revenues: $1.6 billion. DO is part of the strong acting energy sector. Today, DO breaks out from a 12-week flat base today. The key to the breakout is the big expansion in volume over the prior sessions. So far today, DO is trading 3.5 million shares, double its normal daily volume of 1.8 million shares.

The stock - like many energy issues - got off to a strong start in the morning. TTD's clip of the tape shows a big block of 94,500 shares crossing the tape on a modest up tick to $130 from the prior trade at $129.31.

The block showed aggressive institutional buying at the time of the breakout.

DO contracts with some of the largest oil and gas companies to drill in places such as Brazil and Australia.

The company was a wholly owned subsidiary of Loews until 1995, when the parent company publicly offered a portion of the contract driller.

DO's stock has participated nicely in the current bull market in energy stocks. TTD's long-term chart shows DO soaring from 22 in 2004 to 131. It remains in an up trend on TTD's long-term chart. TTD's performance chart shows DO appreciating 57% the past year compared with a decline of 8% in the S&P 500.

TTD's daily chart shows DO's breakout from a flat base. The move does not carry the stock to a new high. So, to many who follow new highs, DO's move is a bit hidden.

Nevertheless, the breakout looks good. The base was well formed with DO spending a few days near the top of the base. The breakout move today shows a widening of the spread (range from high to low), which is bullish.

The stock's TTD momentum indicator (top of chart) is strongly bullish. The accumulation - distribution line is working higher indicating solid buying taking place.

DO should show an acceleration in quarterly earnings growth. That could well be the key driver to send the stock higher in coming weeks. Net for the first quarter should rise 34% and in the second quarter 44%.

Net for the first quarter should be up 34% to $2.20 a share from $1.64 a year ago. The highest estimate on the Street is at $2.40 a share.

Net for the second quarter is projected to be $2.61 a share, up from $1.81 a year ago.

The company will report first quarter net on April 24.

For the year, profits are expected to jump 63% to $10.66 a share from $6.54 a year ago. The stock sells with a price-earnings ratio of 12. TTD sees that as low and attractive for institutions that are value-growth players. Next year, DO's profits should increase 18% to $12.60 a share.

Strategy Opinion: DO is a solid big cap play in the energy sector. TTD is calling for the stock to advance to 160 within the next few months. TTD does see the potential for a stock split which could get the stock moving higher quickly. A protective stop can be placed near 125 giving it some room, TTD rates DO as a good intermediate-term play as long as the energy sector continues to act bullishly.

Sponsorship: Very Good. The largest fund buyer lately was 5-star rated American Funds Growth Fund of America which purchased 727,000 shares. Also, 4-star rated Calamos Growth Fund was a recent buyer of 350,000 shares.

Insider Activity: Neutral. Insiders were just light buyers lately. Currently, 19 analysts follow the stock, 15 have a buy, up from 13 three months ago.

Stock Performance Chart for One Year versus the S&P 500 index.

| TTD's Breakout Profile

Rating Diamond Offshore Drilling Inc. (DO) |

| TTD Check List | Bullish | Bearish | Neutral |

| Near 52-week High | YES | ||

| Volume Expansion | YES | ||

| Tick Volume | YES | ||

| Price Trend - Daily | YES | ||

| Price Trend - Long Term | YES | ||

| Price Daily Spread | YES | ||

| Base Structure | YES | ||

| Base - A-D | YES | ||

| Earnings-Quarterly | YES | ||

| Earnings-Long Term | YES | ||

| Earnings Outlook | YES | ||

| Industry Group | YES | ||

| Prior Breakout Success | YES | ||

| Fund Sponsorship | YES | ||

| Total Score | 14 | 0 | 0 |

(The “breakout List” gives all stocks breaking out of a base of five weeks or more. These stocks have a good chance to trend higher. However, a stop should be used to avoid those that do not work.

(Trading strategy: One should buy breakout stocks at breakpoint by using market order or stop buy)

Charts of Breakout Stocks

Set a Stop Buy at 51.30 to Catch the Breakout

Profits to Jump 271% This Year, TTD Sees Move to 64

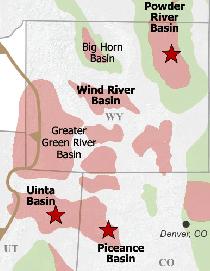

BBG, based in Denver, explores and produces natural gas and oil in the Rocky Mountains. Annual revenues: $390 million. BBG moves higher today and moves into position to breakout. The stock has doubled the past 12 months from 25 to 50. It is now in a well-formed, nine-week, cup-and-handle base. With big earnings gains coming this year, TTD sees the stock in an ideal spot to be accumulated in anticipation of a breakout.

So far today, BBG is trading a light 278,678 shares. Its average daily volume is 684,000 shares. The low volume fits well with the current basing pattern.

TTD's clip of the tape shows the largest trade in the stock in the past two sessions. It is a big block of 49,800 shares, crossing on a modest up tick to $50 from the prior trade at $49.98.

BBG has proven reserves of 428 billion cubic feet of natural-gas equivalent, with average daily production of 143 million cubic feet.

Natural gas makes up 92% of production and 88% of proven reserves.

TTD's map shows the various prospecting areas. The company, like many energy plays, is benefiting from the rise in prices.

TTD's long-term chart of BBG shows the stock coming public in 2006 and trading around 30. It declined to 25 a few months later. However, after that dip it has gone into a solid up trend.

TTD's daily chart shows BBG setting up its base by climbing from 36 in January to 50 in February. The stock then pulled back and proceeded to form a very nice cup-and-handle base.

The base has shown a good contraction in volume near the lows and at the current "handle" portion of the base.

The stock's technicals are very bullish. The accumulation - distribution line (bottom of chart) is in a strong up trend. That indicates some aggressive buying has been taking place.

The TTD momentum indicator (top of chart) is bullish.

This year, analysts predict BBG's profits will leap 272% to $1.82 a share from 49 cents a year ago. The stock sells with a price-earnings ratio of 27, which is reasonable given future growth.

Next year, the Street projects profits will increase 29% to $2.35 a share from $1.82 a share a year ago. The company is benefiting from the rise in gas and oil prices.

The company will report first quarter net May 6.

The Street is predicting a big 101% leap in net to 42 cents a share from 21 cents a year ago. The highest estimate on the Street is at 57 cents a share.

Strategy Opinion: BBG is well positioned to breakout at any time. TTD suggests accumulation of BBG as a partial stake with further buying to be done on a move over 51.30. TTD is targeting BBG for a move to 64. A protective stop can be placed near 47. TTD rates BBG a very good intermediate-term play because of its strong earnings outlook.

Sponsorship: Good. The largest fund buyer lately was Janus Mid Cap Value Fund, 5-star rated, which purchased 200,000 shares. The largest fund holder is 2-star rated Franklin Small-Mid Cap Growth Fund with a big 7.5% stake. However, it sold 413,000 shares recently.

Insider Activity: Neutral. Just some light insider selling. Currently, 10 analysts follow the stock, 4 have a buy, 4 are neutral, and 2 have a sell.

Ticker Tape Digest’s Daily List of “Stocks To Sell or Sell Short” ranks stocks well timed to be sold immediately based on daily trading. The list can be used as an alert to reduce current long-term positions.

Shorts from tape action so far today - 12

Stocks Screened - 8,200

Long-Term Environment for bears: Neutral

Bear Side - Large number of breakdown stocks for a mixed market. Bears be venturesome. Financial stocks dominate the breakdowns today.

(Trading strategy: These stocks can be sold short, or if held should be sold. If a stock is sold short, a protective stop buy should be placed. Short plays work best when the stock market is in a down trend.)

CYMI, based in San Diego, makes photolithography light sources used in the production of semiconductors. Annual revenues: $520 million. CYMI's stock gaps lower today after a brokerage firm Credit Suisse cut its rating. The gap move loser on a big expansion in volume is very bearish. TTD sees more to go on the downside for CYMI. So far today, the stock is trading 1.8 million shares, triple its normal daily volume of 606,000 shares.

TTD spotted a big block crossing in the stock late on Friday (see table). A block of 64,000 shares crossed the tape on a big down tick to $25.63 from the prior trade at $26.22. That is an awesome "down tick" and says heavy sellers were hitting the stock.

CYMI's stock has been in a down trend since peaking at 56 in early 2006.

CYMI's customers include all three photolithography tool makers--ASM Lithography, Canon, and Nikon--as well as major semiconductor manufacturers such as Intel, Texas Instruments, and Samsung.

This year, analysts are forecasting a 34% drop in CYMI's earnings to $1.65 a share from $2.50 a year ago.

The company has been showing a contraction in profit margins. Net for the first quarter is expected to drop 33% to 35 cents a share from 52 cents a year ago.

TTD's daily chart shows the gap move lower today under cutting key support near 24.50. Technically, the stock has continued to act weak. The accumulation - distribution line is in a steep down trend. That shows heavy selling pressure for months. TTD is targeting CYMI for a drop to 19 within the next few months.

TTD columnist Leo Fasciocco has covered the stock market for over 20 years. His articles appear in many publications. He is also a speaker at the Intershow conferences. He has been on television and radio. He is author of many educational articles about stock investing and the book “Guide To High-Performance Investing.”

For information to subscribe to the Ticker Tape Digest Services call: B. J. Owen at 1-480-926-1680. Distributed by Corona Publishing Enterprises. Ticker Tape Digest Inc. P.O. Box 2044 Chandler, Az. 85244-2044. TTD “Professional Report” is available on the World Wide Web: $100 per month. Password needed. “TTD Professional“ Faxed is $200 per month. The TTD Daily Report is $39.95. Credit cards accepted.

(The information contained has been prepared from data deemed reliable but there is no guarantee of complete accuracy. Ticker Tape Digest Inc. is not affiliated with any broker, dealer or investment advisor. Nothing in this publication constitutes an offer, recommendation or solicitation to buy or sell any securities. Further research is advised. This report is copyrighted and no redistribution is permitted with out permission. Some of the charts are from Telescan, Insight Trading, First Alert and other sources.)